Unfortunately, many assume that filing for bankruptcy is as simple as submitting a few forms and watching your debt disappear. While this would be great, the reality of this matter is much more complex. In fact, in order to qualify for Chapter 7 bankruptcy, you must first pass a means test. If you’re unsure what this is or how to pass, you’ll want to continue reading. The following blog explores what you should know about these matters, including what happens if you fail and the importance of working with a Memphis, TN Chapter 7 bankruptcy lawyer.

What Is the Chapter 7 Means Test?

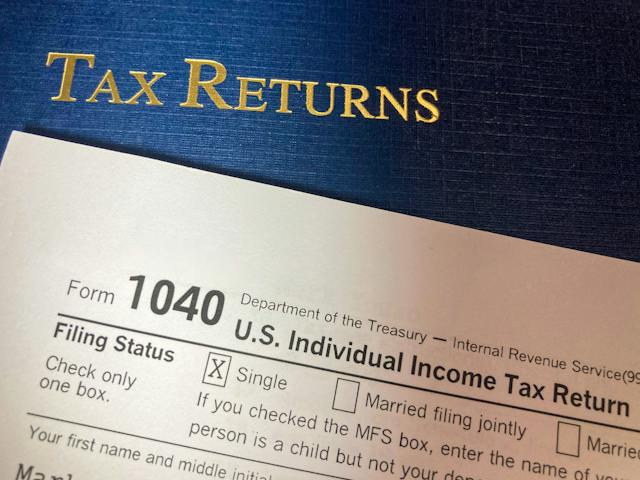

In order to file for Chapter 7 bankruptcy, you must pass what’s known as the means test. Essentially, this compares your income to other incomes of your household size in Tennessee. If your income is higher than average, you cannot pursue this chapter.

However, you may be able to deduct certain expenses to help you pass the means test if your income is too high to qualify. Generally, the most impactful expenses include mortgage payments, outstanding taxes, childcare, and disability insurance, among other factors. As such, if you have no disposable income due to these expenses, you can qualify for Chapter 7, as Chapter 13 would not be beneficial for your creditors. However, some deductions are more impactful than others, so it is always best to consult with an experienced attorney if you believe you’ll need to factor these to qualify.

What Happens if I Fail?

In the event you do not pass the Chapter 7 means test, it’s important to understand your options. First and foremost, you should note that failure to pass the test does not mean you cannot pursue bankruptcy. Instead, you’ll need to pursue a different chapter. Most commonly, you may choose to pursue Chapter 13.

A Chapter 13 filing is much different than a Chapter 7, as there is no liquidation of assets. Instead, this process places you on a three- to five-year repayment plan in which you make a singular monthly payment for all your debts. As such, every payment you make to your trustee will then be distributed to your creditors. In fact, many choose to pursue Chapter 13 over Chapter 7 as it can help protect their secured assets, meaning they will be able to retain them after the bankruptcy case has concluded. Additionally, at the end of Chapter 13, the remaining eligible debts will be discharged.

Bankruptcy can be an incredibly complicated process to navigate on your own. As such, it is in your best interest to connect with an experienced attorney with the Arnold Law Firm. We understand how difficult these matters can be, which is why we will do everything in our power to help you navigate this process. When you need help, reach out to our firm today to learn why so many in and around Memphis have turned to us for assistance with bankruptcy.